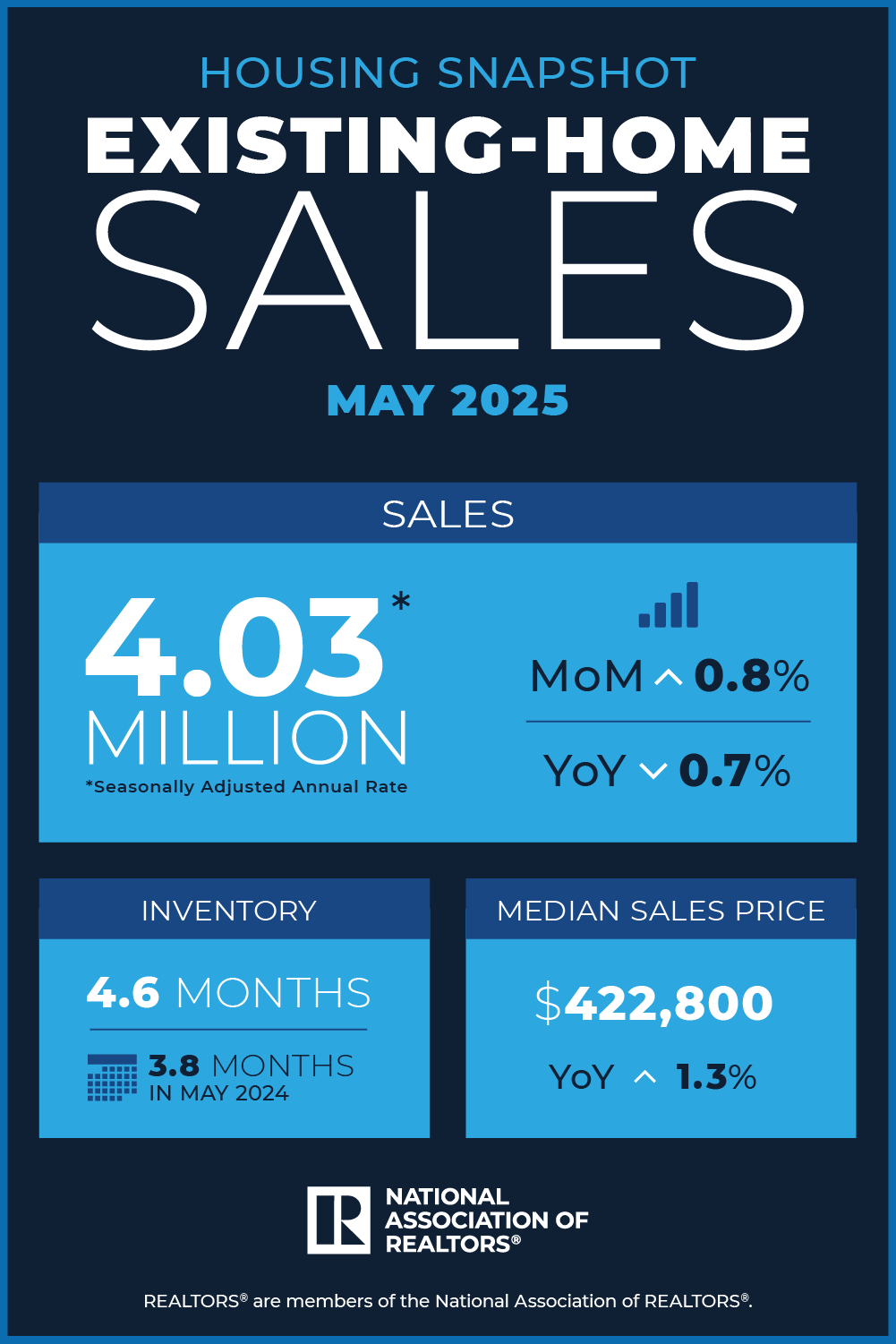

Note: May 2025 data below are the most recent released by the National Association of Realtors.

- 0.8% increase in total existing-home sales1 month-over-month to a seasonally adjusted annual rate of 4.03 million.

- 0.7% decrease year-over-year, sales declined 0.7% (down from 4.06 million in May 2024).

- 1.54 million units: Total housing inventory2, up 6.2% from April and 20.3% from May 2024 (1.28 million).

- 4.6-month supply of unsold inventory, up from 4.4 months in April and 3.8 months in May 2024.

- $422,800: Median existing-home price3 for all housing types, up 1.3% from one year ago ($417,200) – a record high for the month of May, and the 23rd consecutive month of year-over-year price increases.

- Single-Family and Condo/Co-op Sales

- Single-Family Homes in May

- 1.1% increase in sales to a seasonally adjusted annual rate of 3.67 million, up 0.3% from May 2024.

- $427,800: Median home price in May, up 1.3% from May 2024.

- Condominiums and Co-ops in May

- 2.7% decrease in sales to a seasonally adjusted annual rate of 360,000 units, down 10.0% from May 2024.

- $371,300: Median price, up 0.7% from May 2024.

- 4.2% increase in sales month-over month to an annual rate of 500,000, up 4.2% year-over-year.

- $513,300: Median price, up 7.1% from May 2024.

- 2.1% increase in sales month-over month to an annual rate of 990,000, up 1.0% year-over-year.

- $326,400: Median price, up 3.4% from May 2024.

- 1.7% increase in sales month-over month to an annual rate of 1.84 million, down 0.5% year-over-year.

- $367,800: Median price, down 0.7% from May 2024.

- 5.4% decrease in sales month-over month to an annual rate of 700,000, down 6.7% year-over-year.

- $633,500: Median price, up 0.5% from May 2024.